PPM IS SOLELY FOCUSED ON PERFORMANCE

We embrace market inefficiencies and volatility which is important for creating value for clients, with a strategic commitment to a relative value, fundamentals-based investment style. This approach shifts tactically in response to changing relative valuations, market environments and business cycles. In tandem with risk management, our investment team strives to ensure that portfolios are balanced and designed for stable, long-term performance.

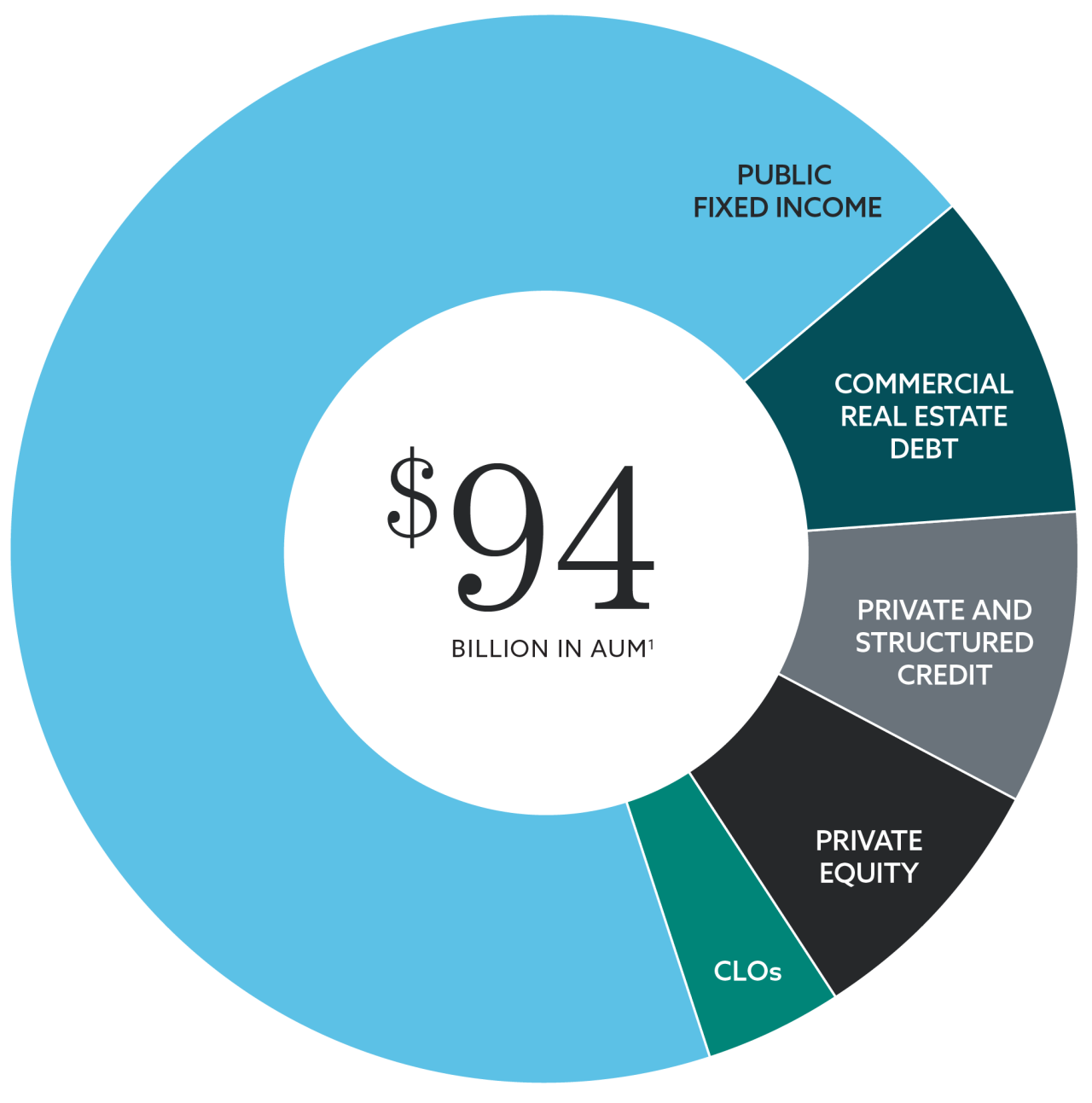

Public FIXED INCOME >

Our expertise spans a wide range of strategies including investment grade, high yield and bank loan.

COMMERCIAL REAL ESTATE Debt >

The team lends stability and brings a wealth of knowledge to both the investment process and overall management of Commercial Mortgage Loans, Commercial Mortgage Backed Securities and Real Estate Investment Trusts.

PRIVATE & STRUCTURED CREDIT >

Embedded within our broader fixed income team, our credit analysts and dedicated private and structured credit team collaborate on both credit and structural points from the onset of every deal.

PRIVATE EQUITY >

The team's deep network of relationships provides access to a wide and diverse set of primary and co-investment opportunities.

COLLATERALIZED LOAN OBLIGATIONS >

CLOs are a natural extension of our investment activities and expertise in floating rate corporate bank loans, leveraging the talent and experience of our CLO management team.

(1) As of December 31, 2025. AUM includes committed but unfunded capital for PPM's private equity and commercial real estate businesses. AUM includes both securities issued by PPM CLO vehicles held by PPM separately managed account clients and the underlying collateral assets of the CLO vehicles managed by PPM.