May 31, 2022

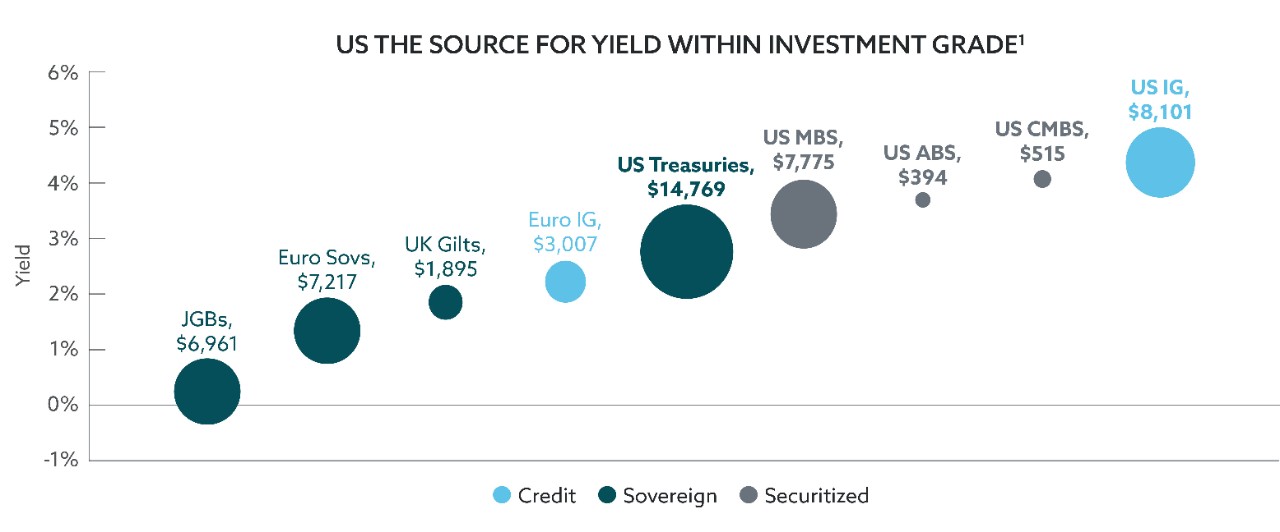

Nine months ago, amid a low interest rate environment, US fixed income was the source for yield on a relative basis. Fast forward to today and times sure have changed. Inflation has proven persistent, driven by supply chain constraints, post-pandemic demand and rising wages. This environment has led many global central banks to begin interest rate hiking cycles, with participants quickly raising market yields in anticipation. These factors have led to a very volatile period for global markets.

However, while the absolute level of yields has shifted significantly higher, the relative comparison has not shifted all that much. US fixed income remains the global source for yield.

KEY TAKEAWAYS

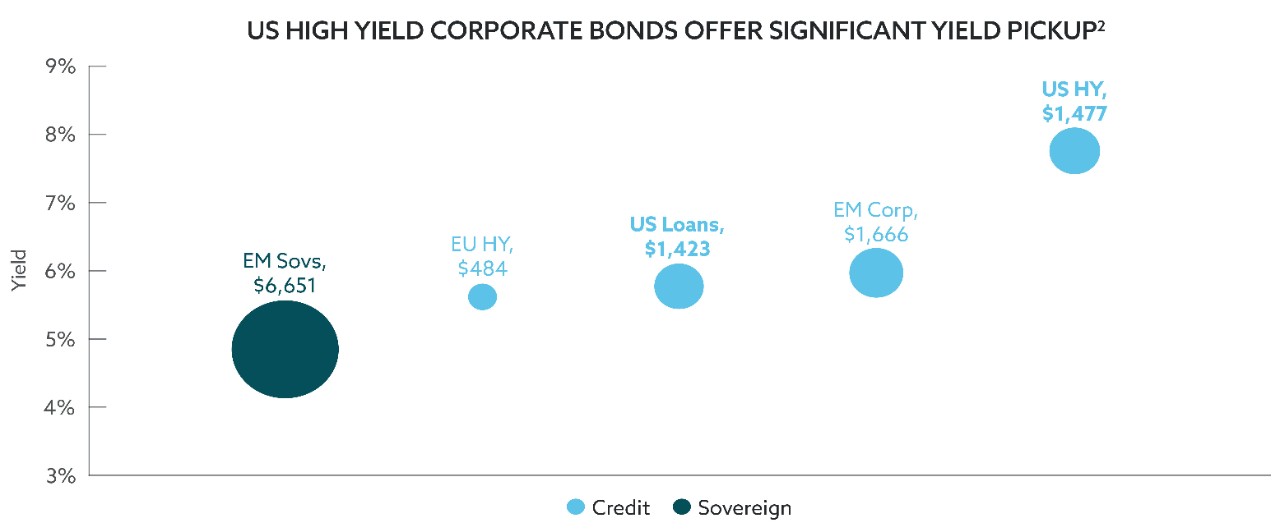

- Amid the significant increase in market yields, US fixed income has maintained its relative yield advantage to global counterparts

- Finding sectors and credits that can effectively handle rising input costs and decelerating growth is key to taking advantage of the higher yields offered in the US market

- Hedging costs for foreign investors into the US have risen but, in many cases, the US yield pickup remains attractive

1) ICE Data Services. Yields as of 20 May 2022. Bubble size represents the size of each asset class in USD, as of 30 April 2022. Indices are the ICE BofA Japan Government, ICE BofA Euro Government, ICE BofA UK Gilt, ICE BofA Euro Corporate, ICE BofA US Treasury, ICE BofA US Mortgage Backed Securities, ICE BofA US Fixed Rate Asset Backed Securities, ICE BofA US Fixed Rate CMBS and ICE BofA US Corporate. (2) ICE Data Services. Yields as of 20 May 2022. Bubble size represents the size of each asset class in USD, as of 30 April 2022. Indices are the ICE BofA Emerging Markets Sovereign Bond, ICE BofA Euro High Yield, S&P/LSTA Leveraged Loan, ICE BofA Emerging Markets Corporate Plus and ICE BofA US High Yield.

Unless otherwise stated, the information presented has been prepared from market observations and other sources believed in good faith to be reliable. Information and opinions expressed by PPM are current as of the date indicated and are subject to change without notice. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed.

Past performance is no guarantee of future results. Investments involve varying degrees of risk and may lose value.

© 2025 PPM America, Inc. All rights reserved.