February 12, 2023

After a tumultuous 2022 which saw double-digit losses in both fixed income and equity markets, many investors likely entered the new year understandably cautious.1 The push-and-pull between the Federal Reserve’s policy actions to combat inflation and the market’s expectations continues, while growth concerns and a possible recession remain macro headwinds.

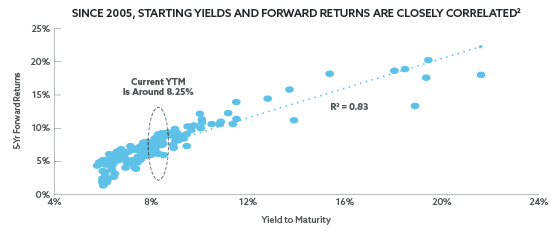

Given current market conditions, investors may need to look for opportunities that strike the right risk/reward balance. High yield bonds can offer an attractive blend with potential for higher income than investment grade corporate bonds and historically lower standard deviations when compared to equities.

KEY TAKEAWAYS

- In our opinion, high yield bonds offer investors an attractive risk/reward profile compared to other asset classes – higher income potential than investment grade corporate bonds and historically less volatility than equities

- With the run-up in yields over the past year, the prospects for income generation in high yield bonds have improved

- At current dollar prices, high yield bonds also have the potential for capital appreciation

(1) As of 13 February 2023. (2) ICE Data Services, Morningstar. Monthly yields and 5-year forward returns for the ICE BofA US High Yield Index from January 2005 through December 2018.

Unless otherwise stated, the information presented has been prepared from market observations and other sources believed in good faith to be reliable. Information and opinions expressed by PPM are current as of the date indicated and are subject to change without notice. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed.

Past performance is no guarantee of future results. Investments involve varying degrees of risk and may lose value.

© 2025 PPM America, Inc. All rights reserved.