May 24, 2023

The troubled Office sector is just one of the major property types within the CRE debt market, along with Hotels, Industrial, Multifamily and Retail, but the narrative surrounding CRE seems to be applied to all sectors. Separately, banks and CMBS have pulled back significantly as sources of loan supply ahead of an expected pickup in refinancing activity. We see opportunities in today's admittedly volatile market environment to invest at potentially lower leverage points, higher yields and more favorable structures.

KEY TAKEAWAYS

The narrative surrounding US commercial real estate (CRE) seems to be applied to all property types, but we believe fundamentals outside of Office remain relatively healthy

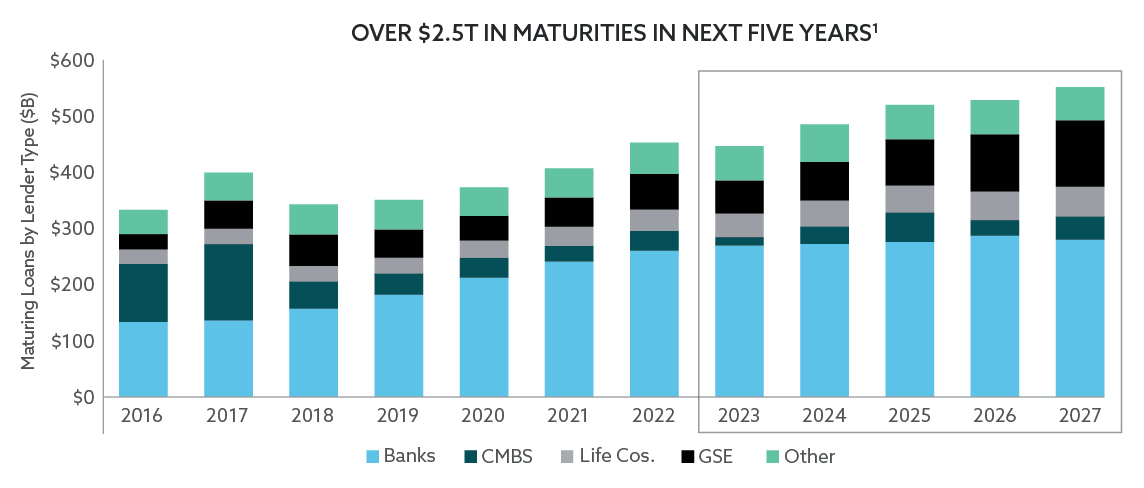

With banks and CMBS having pulled back from the market, a void has been created, while we expect lending to pick back up as over $2.5T in loans mature through 2027

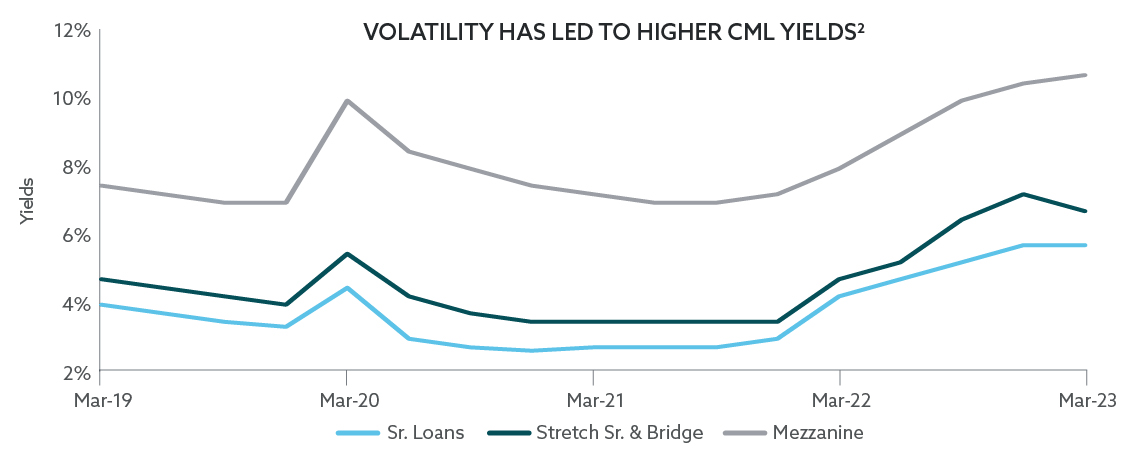

Current market volatility can allow investors to lend at lower leverage points and higher yields, as well as more favorable structures (e.g., tighter loan covenants)

It can be difficult for investors to maintain, or even increase, CRE exposure in the current environment, but we believe it is the right time to do just that

(1) Trepp, Inc. Based on Federal Reserve Flow of Funds data through Q3 2022. (2) Cushman & Wakefield. Quarterly yields through 31 March 2023. CRE data is calculated by PPM using third-party sources, in particular Cushman & Wakefield.

Unless otherwise stated, the information presented has been prepared from market observations and other sources believed in good faith to be reliable. Information and opinions expressed by PPM are current as of the date indicated and are subject to change without notice. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed.

Past performance is no guarantee of future results. Investments involve varying degrees of risk and may lose value.

© 2025 PPM America, Inc. All rights reserved.