July 11, 2023

When discussing our LDI-Long Duration strategy with prospective clients, they often have questions about our custom benchmarks. The use of completion managers, while proven, can be arduous considering the need to consistently rebalance. This paper outlines how custom benchmarks could act as a complement to a pension fund's LDI portfolio and why we believe fixed income assets need to be better calibrated to liability profiles due to higher funding ratios.

KEY TAKEAWAYS

Custom benchmarks could complement a pension fund’s liability-driven investment (LDI) portfolio, as many investors require unique risk parameters (e.g., duration targets, credit quality, ESG considerations)

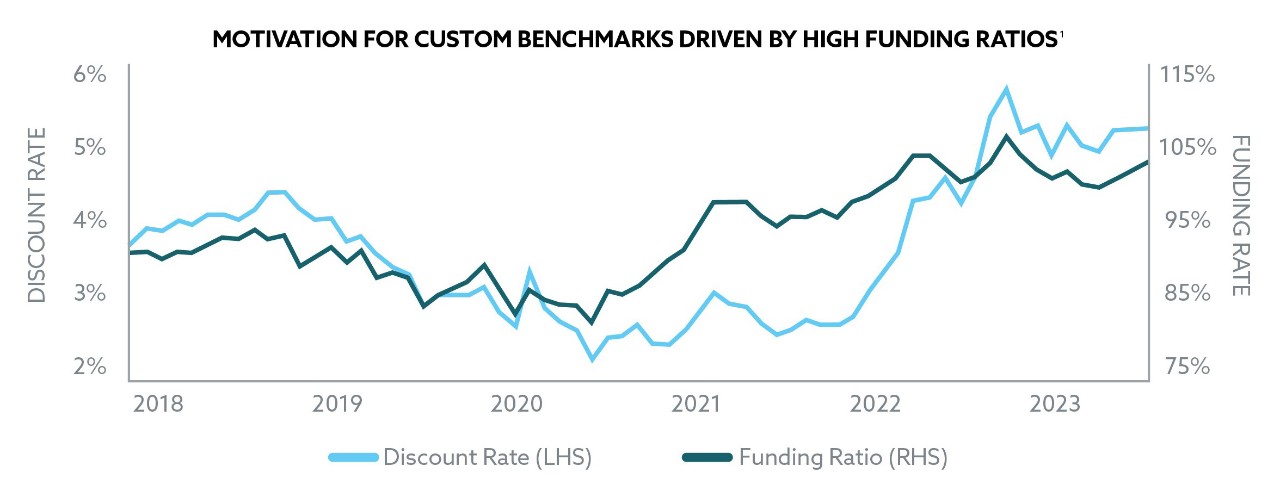

Rising discount rates led to an increase in pension funding ratios and we believe fixed income assets need to be better calibrated to liability profiles, which is when customization can be useful

The vast majority of LDI-Long Duration assets PPM manages on behalf of clients use custom benchmarks

(1) Bloomberg. Monthly data for the Milliman 100 Pension Funding Index through 30 June 2023.

Unless otherwise stated, the information presented has been prepared from market observations and other sources believed in good faith to be reliable. Information and opinions expressed by PPM are current as of the date indicated and are subject to change without notice. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed.

Past performance is no guarantee of future results. Investments involve varying degrees of risk and may lose value.

© 2025 PPM America, Inc. All rights reserved.