September 17, 2023

Investors historically allocate funds to separately managed public credit and private credit strategies. As an alternative, they can now leverage the strengths of both markets through PPM America's Investment Grade Public/Private Credit Strategy, which can provide greater yield/spread potential, diversification and financial protections. This spotlight showcases how the potential benefits inherent in the strategy may be relevant to your investment goals.

KEY TAKEAWAYS

Historically, investors allocate funds to separately managed public credit and private credit strategies

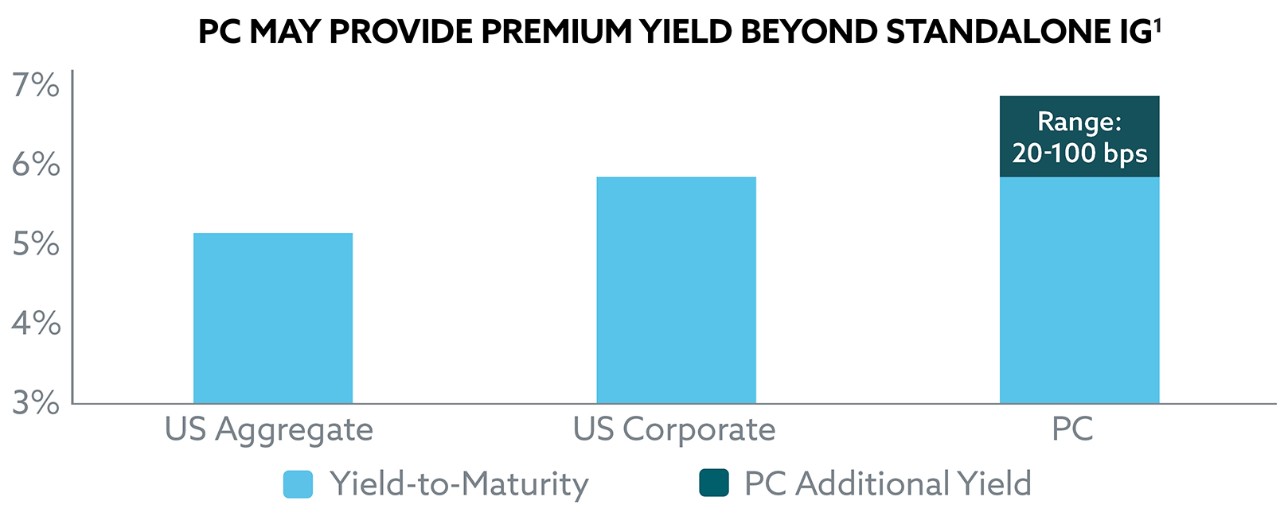

As an alternative, investors can leverage the strengths of both markets through our Investment Grade Public/Private Credit (IGPPC) Strategy, which can provide greater yield/spread potential, diversification and financial protections

Institutional investors in need of a Liability-Driven Investment (LDI) strategy have the option of building a customized IGPPC strategy

Each client’s IGPPC strategy is defined by their individual goals, constraints and tolerances; these inform our recommended portfolio allocations and customized liquidity and return targets

(1) Bloomberg. Yield-to-maturity of Bloomberg US Aggregate Bond Index and Bloomberg US Corporate Bond Index as of 18 August 2023.

Unless otherwise stated, the information presented has been prepared from market observations and other sources believed in good faith to be reliable. Information and opinions expressed by PPM are current as of the date indicated and are subject to change without notice. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed.

Past performance is no guarantee of future results. Investments involve varying degrees of risk and may lose value.

© 2025 PPM America, Inc. All rights reserved.