October 01, 2023

The spring's US regional banking crisis thrust the sector to the forefront for investors. Higher capital buffers, high interest rates and the potential for deposit flows require more active monitoring and research. PPM America consistently researches and invests in the sector on behalf of clients. This spotlight addresses regulatory proposals and their potential impacts on regional bank bond issuance, as well as our takeaways from a recent financial conference.

KEY TAKEAWAYS

Regulatory proposals have raised the prospects of significant new bond issues for US regional banks, with potential repercussions for investor portfolios and analysis needed to find the best positioned banks

PPM consistently researches and invests in the sector on behalf of our clients; there are long-term risks but also opportunity, as we expect increased capital levels

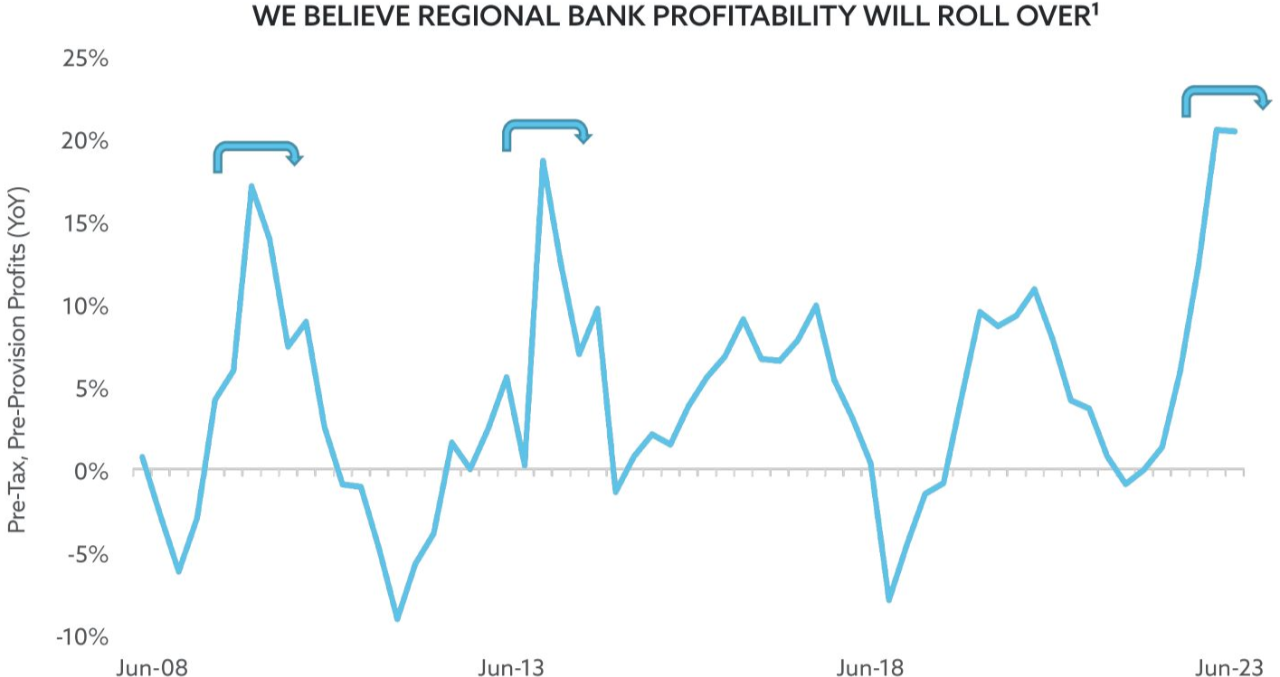

(1) Federal Reserve, SNL Financial, Bloomberg, company reports. As of 30 June 2023, the latest available. Rolling four-quarter PTPP profits for 11 US regional banks tracked by PPM, shown as year-over-year growth rates. PTPP profits = net interest income + non-interest income - non-interest expenses + goodwill impairment/intangible amortization charges + mortgage reps and warranty charges.

Unless otherwise stated, the information presented has been prepared from market observations and other sources believed in good faith to be reliable. Information and opinions expressed by PPM are current as of the date indicated and are subject to change without notice. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed.

Past performance is no guarantee of future results. Investments involve varying degrees of risk and may lose value.

© 2025 PPM America, Inc. All rights reserved.