December 12, 2023

As investors look ahead to financial markets in 2024, economic fundamentals could be a dominant factor in the outcome. The consequences of higher rates have not been straightforward. Households and corporations were able to quickly invest assets at higher interest rates, but their liabilities did not immediately reprice higher as many have long durations. As an accompaniment to our 2024 asset class outlooks, this report quickly analyzes household and corporate fundamentals.

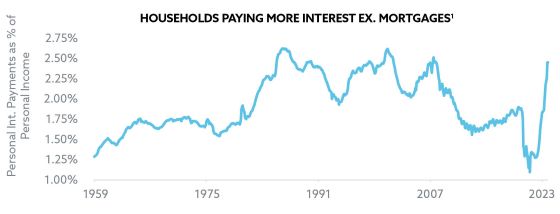

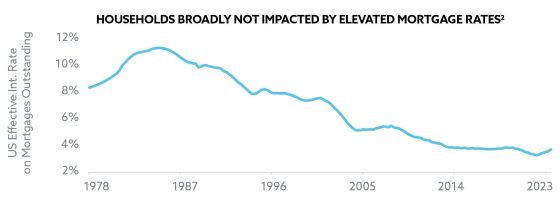

For consumers, we believe today's elevated mortgage rates will have a limited effect in 2024, but interest rates on auto loans and credit cards could weaken household balance sheets. For corporations, we believe higher interest rates will start to bite in 2024 given the need for both new and refinanced debt, but expect only a measured increase in distress and defaults, not a spike.

KEY TAKEAWAYS

As investors look ahead to financial markets in 2024, economic fundamentals could be a dominant factor in the outcome

Apart from the soft-landing debate, understanding the health of households and corporations could be necessary to determine how higher interest rates are likely to impact fundamentals

For consumers, we believe today’s elevated mortgage rates will have a limited effect in 2024, but interest rates on auto loans and credit cards could weaken household balance sheets

For corporations, we believe higher interest rates will start to bite in 2024 given the need for both new and refinanced debt, but expect only a measured increase in distress and defaults, not a spike

(1) FactSet. Personal interest payments consist of non-mortgage interest paid by households. Monthly data through October 2023, the latest available. (2) Bloomberg. Quarterly data through Q3 2023.

Unless otherwise stated, the information presented has been prepared from market observations and other sources believed in good faith to be reliable. Information and opinions expressed by PPM are current as of the date indicated and are subject to change without notice. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed.

Past performance is no guarantee of future results. Investments involve varying degrees of risk and may lose value.

© 2025 PPM America, Inc. All rights reserved.