April 28, 2024

Investors are facing tougher portfolio management decisions as US public markets trade at rich valuations.1 Re-examining market drivers for dislocations between perceived and actual risks could be a benefit. We believe the current commercial real estate (CRE) market is misunderstood by investors, as the secular shift negatively impacting the office sector is not the same headwind other major property types might face. Attributes to consider for hotel, industrial, multifamily and retail include:

Fundamentals remain generally supportive outside of office;

Lenders have been lowering leverage and tightening covenants on new deals;

Dislocation in the banking sector has caused banks – historically the largest of the four primary providers of CRE debt – to reduce their allocations.

Together, these attributes make it a more attractive entry point into CRE debt. We believe the middle market within Core Plus Real Estate Debt offers the most compelling opportunity today, but will require broker/borrower relationships and a repeatable, fundamental investment process.

KEY TAKEAWAYS

Investors are facing tougher portfolio management decisions as US public markets trade at rich valuations; re-examining market drivers for dislocations between perceived and actual risks could be a benefit

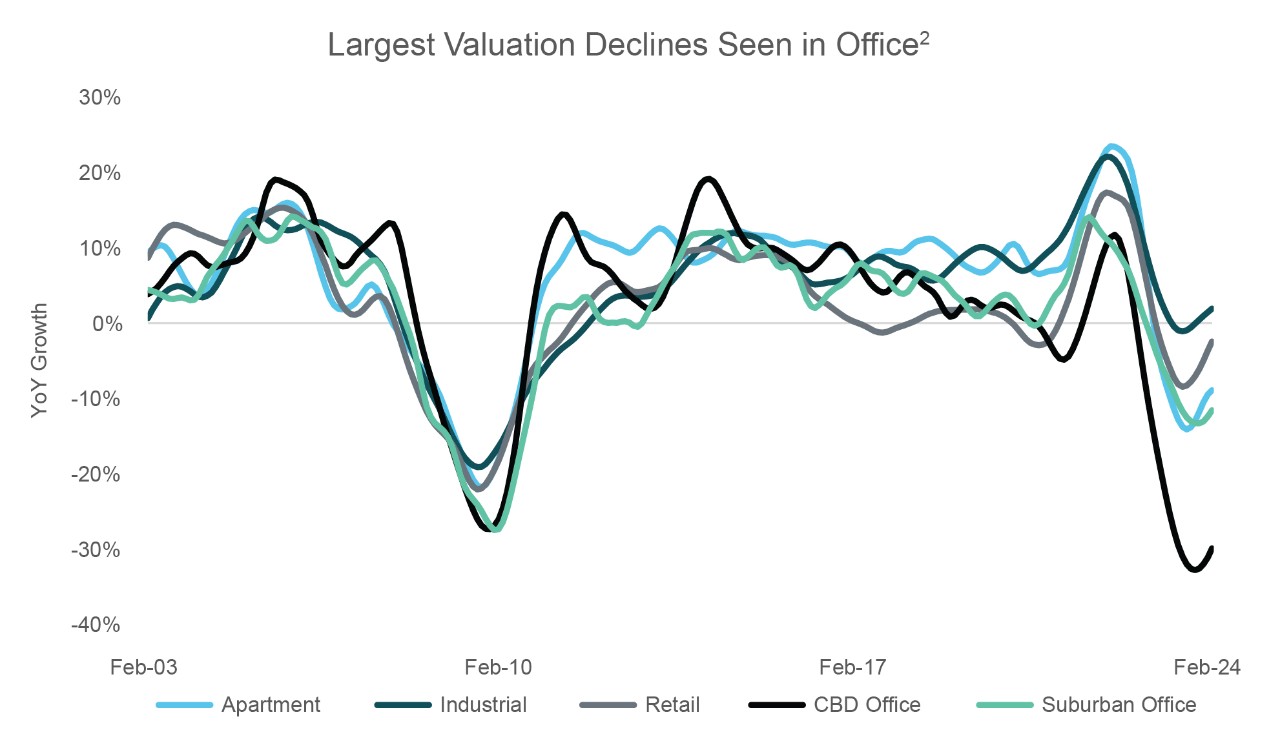

We believe the current CRE market is misunderstood by investors, as the secular shift negatively impacting the office sector is not the same headwind other major property types might face

Fundamentals remain generally supportive outside of office; lenders have been lowering leverage and tightening covenants on new deals, making it a more attractive entry point to CRE debt

Dislocation in the banking sector has caused banks – historically the largest of the four primary providers of CRE debt – to reduce their CRE allocations

We believe the middle market within Core Plus Real Estate Debt offers the most compelling opportunity today, but will require broker/borrower relationships and a repeatable, fundamental investment process

(1) As of 25 April 2024. (2) Bloomberg. Year-over-year changes of the RCA CPPI Indices. Monthly data through 31 March 2024.

Unless otherwise stated, the information presented has been prepared from market observations and other sources believed in good faith to be reliable. Information and opinions expressed by PPM are current as of the date indicated and are subject to change without notice. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed.

Past performance is no guarantee of future results. Investments involve varying degrees of risk and may lose value.

© 2025 PPM America, Inc. All rights reserved.