May 21, 2024

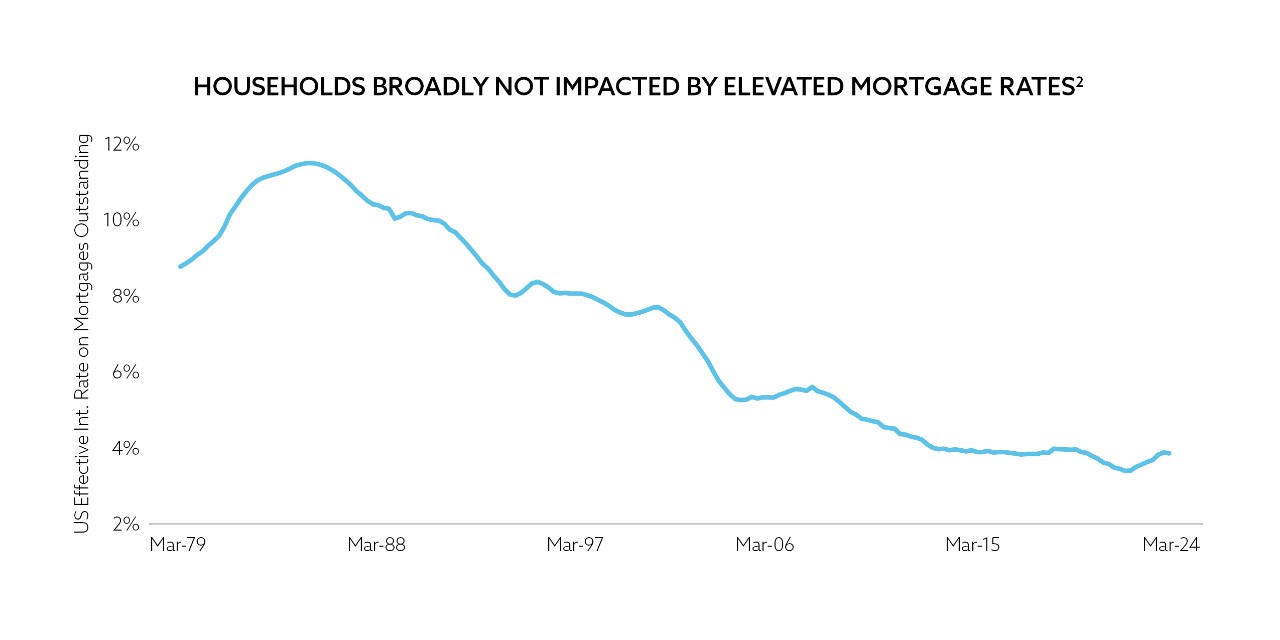

The idea that rising rates can stimulate the economy is a fringe economic theory that appears to be getting more attention.1 A record amount of interest-bearing assets on household balance sheets help show how, aided by increasing interest payments from the US federal government. Our view is that higher rates are simply doing less economic damage than in the past. There are two secular shifts unique to this cycle that help explain why – fixed rate mortgages and a record number of retirees.

(1) As of 22 May 2024. (2) Bloomberg. Quarterly data through Q1 2024.

Unless otherwise stated, the information presented has been prepared from market observations and other sources believed in good faith to be reliable. Information and opinions expressed by PPM are current as of the date indicated and are subject to change without notice. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed.

Past performance is no guarantee of future results. Investments involve varying degrees of risk and may lose value.

© 2025 PPM America, Inc. All rights reserved.