January 05, 2025

As investors size up opportunities in the new year, we believe that they need to be mindful of the recent history of each asset class and how that sets the stage for 2025. Fixed income has experienced two years of positive excess returns, weathering the high interest rate environment quite well. Meanwhile, 2023 and 2024 were years of underwhelming activity in both commercial real estate (CRE) and some areas of the private equity (PE) market. We expect opportunities to be abundant in all asset classes in 2025, but we believe individual credit and deal selection will be critical to maximize returns given different starting points.

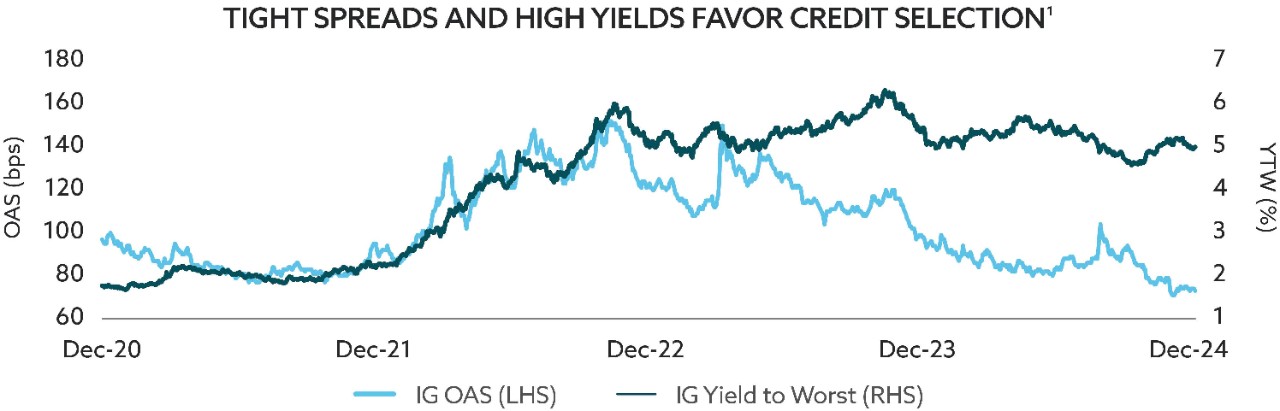

- Investment Grade: We anticipate underlying demand to remain in place as yields remain elevated. But that demand has also led to historically tight spreads, reducing the risk-adjusted return potential. Still, heightened focus on political impacts as well as a more aggressive M&A landscape should provide chances for investors to put their money to work.

- Investment Grade Private Credit (IGPC): By adding IGPC to fixed income portfolios, investors can reduce risk through diversification and covenants while picking up yield over equivalent public corporate bonds. The market should benefit from tailwinds such as limited bank capital, increasing institutional investor demand and growing issuance.

- Leveraged Credit: We expect supportive technicals and fundamentals to remain in place in 2025. However, the three main areas of focus that could impact both high yield bonds and bank loans are employment, inflation and interest rates.

- Private Equity: US PE investors have experienced a pickup in exit activity and signs of a fundraising thaw, driven by lower interest rates, and we expect those areas of the market to improve in 2025.

- Commercial Real Estate: Although the resetting of Office is still ongoing in CRE, we anticipate the solid fundamentals of the other four major property types to remain in place next year. Plus, a rise in maturities in 2025 should provide ample opportunities for lending.

(1) FactSet. Daily spread and yield to worst for the Bloomberg US Credit Index through December 10, 2024.

Unless otherwise stated, the information presented has been prepared from market observations and other sources believed in good faith to be reliable. Information and opinions expressed by PPM are current as of the date indicated and are subject to change without notice. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed.

Past performance is no guarantee of future results. Investments involve varying degrees of risk and may lose value.

© 2025 PPM America, Inc. All rights reserved.