January 07, 2024

Demand for long-dated corporate bonds increased in 2023 with the rise in yields. But with a lack of supply in long-end public credit, where else can investors turn to find similar opportunities? Learn how investment grade private credit can be a source for longer-dated and off-the-run maturities while also providing greater spread potential and covenant protections.

KEY TAKEAWAYS

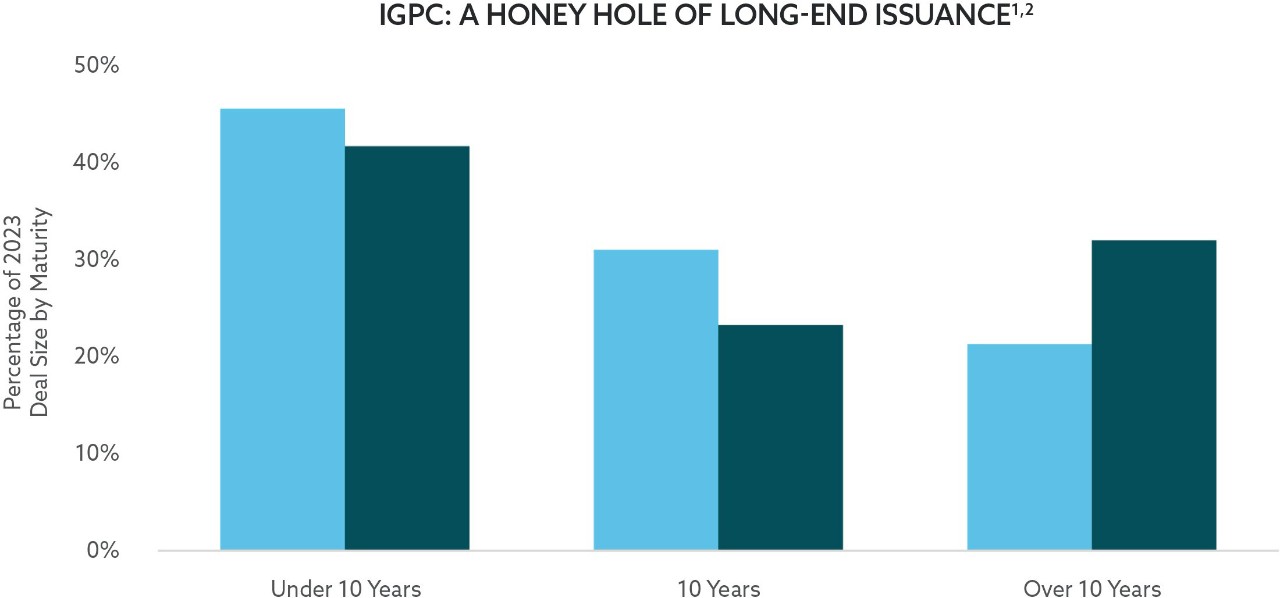

High yields have led to greater investor demand for longer-dated corporate bonds, but supply decreased in 2023

The investment grade private credit (IGPC) market has been a source for longer-term bonds both in 2023 and historically, offering a greater percentage of 10+ year issuance compared to investment grade public credit (IG)

IGPC can also offer other benefits such as greater credit spread potential and covenants to protect from downgrades

(1) As of 30 November 2023. Year-to-date issuance for IG from J.P. Morgan and Dealogic. (2) Unless otherwise indicated, private placement statistics may include issuance amounts, spreads and premiums that are aggregated and calculated by PPM based on compilation of transactions PPM observes in the private placement market. Sources of PPM data may include, but are not limited to, the investment bank or agent sponsoring a transaction, SEC filings, or other third-party data sources obtained by PPM in good faith and believed to be reliable, including the Private Placement Monitor. Data on public bonds used to calculate private placement premiums comes from Bloomberg. IGPC maturity issuance percentage is year-to-date through 30 November 2023.

Unless otherwise stated, the information presented has been prepared from market observations and other sources believed in good faith to be reliable. Information and opinions expressed by PPM are current as of the date indicated and are subject to change without notice. Forward-looking statements are subject to uncertainties that could cause actual developments and results to differ materially from the expectations expressed.

Past performance is no guarantee of future results. Investments involve varying degrees of risk and may lose value.

© 2025 PPM America, Inc. All rights reserved.